Lately I have fielded an awful lot of questions about the housing market on the Front Range. It’s shifting, and it would be hard to miss it. Many are worried that Colorado’s housing market will crash during the next recession.

So, what does this mean for homeowners who are considering selling in the next year or two? While it is true that low-interest loans have been replaced with high-interest loans, thus dampening demand, demand for housing on the Front Range remains quite high.

I don’t think Colorado’s housing market will crash during the next recession.

Why am I, a humble real estate agent, sharing my opinion? Well…because I am in real estate so I think about this a lot, I have a degree in economics (data analysis delights me), and I focus on strengthening my clients’ personal financial position.

With that out of the way…Let’s look at some data!

Crashing Housing Markets

We all remember the massive housing bubble related to the 2008-2009 recession. That was an awful, scary time. The economy was in shambles. Unemployment was high. Uncertainty was everywhere.

The Fed in St. Louis keeps track of all sorts of fascinating data (interest being in the eye of the beholder, of course). One of these is housing prices.

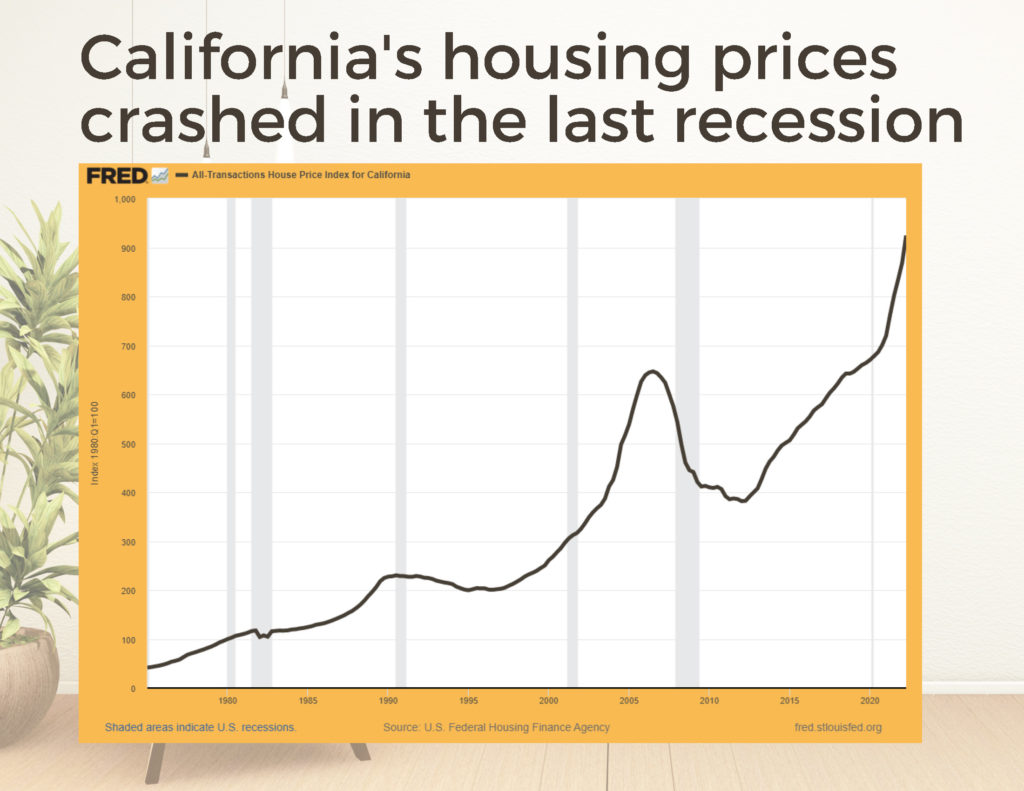

Let’s look at California’s housing housing price index from 1975-2022 in the chart below. The housing prices are in inflation-adjusted units, not dollars, and the gray bars are recessions.

WHOA! That IS a crash. Housing prices fell nearly 40% from 2007-2012. Ouch.

However, real estate markets are LOCAL. While you likely heard about the crashing prices in places like California on the news, what you might not have done was calibrate that info to Colorado, or the Boulder County local housing market. There’s good news ahead: Colorado’s housing prices during recessions tend to be more stable than places like California!

Colorado housing prices during recessions

Good news: Colorado’s housing markets have historically been very stable.

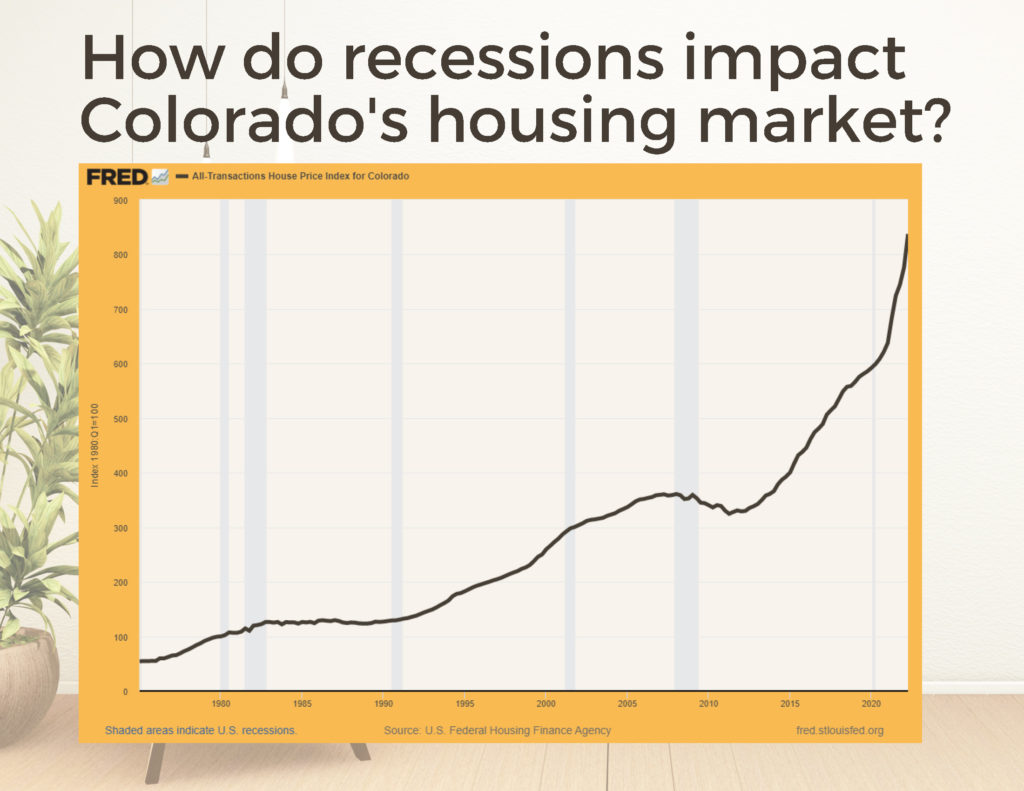

Let’s look at Colorado’s during the same time period.

It does not take any analysis to see the dip in Colorado’s housing prices caused by the 2008-2009 recession. Housing prices, averaged across the state, dipped about 13% from 2008-2011. That’s a lot, so why would I tell you not to fret?

I am not saying 13% is nothing: that is hard to take. However, 13% is not 40%.

But I have more good news than that! Real estate markets are MUCH MORE local than state-wide markets. Colorado’s housing prices during recessions give us a good starting point…but let’s look at housing prices in Boulder County to hone in on a specific Front Range market…because the data actually gets better.

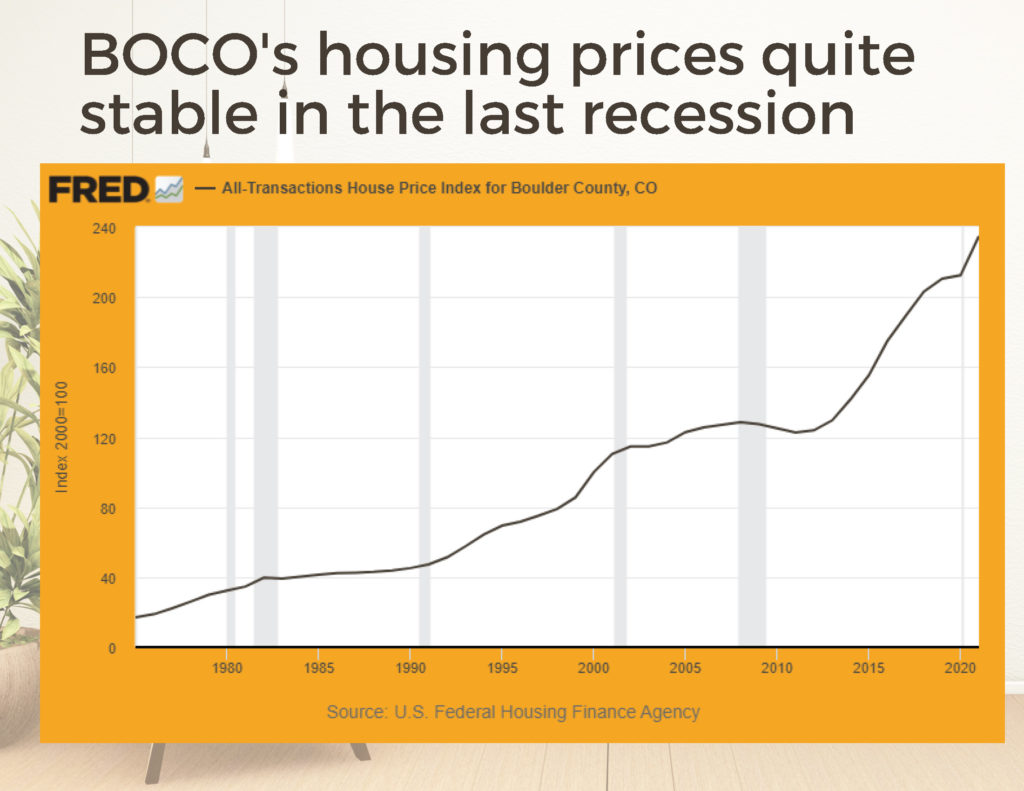

Y’all, the price dip was smaller than the dip in Colorado overall. In fact, Boulder County’s prices only dipped about 4-5%. Why? Because the Northern Front Range is an incredibly desirable place to live!

What does this mean moving forward? COVID forced employers to allow remote work, and many who wanted an opportunity to move to Colorado suddenly had the opportunity.

In summary: I expect that demand, spurred by a growing remote workforce, will remain high. This demand is tempered by higher interest rates, but the fundamentals of the market have not changed. Homes that are well taken care of, remodeled, and appropriately priced still sell quickly. While we are not immune to corrections or leveling out, I don’t believe it will crash…it has never done so to date.

Let’s check back in during 2026/2027 to see how my predictions have held up over time!

Hi, there!

I'm Libby Earthman. I specialize in proactively protecting my clients as they buy and sell homes on Colorado's northern Front Range. I want you to know HOW to make well-reasoned real estate decisions, and I proactively protect your interests during the transaction.

Let's Chat!

Contact

(720) 487-3126

402 Main Street

Longmont, CO 80501

libby@libbyearthman.com