The seasonal lull at year end

We are officially in the market doldrums. If you’re eager to find a new listing, you’ve likely noticed that fewer and fewer houses have been listed in recent weeks. It’s darn right slow, and you know what that means: y’all…the time for thrift is upon us!

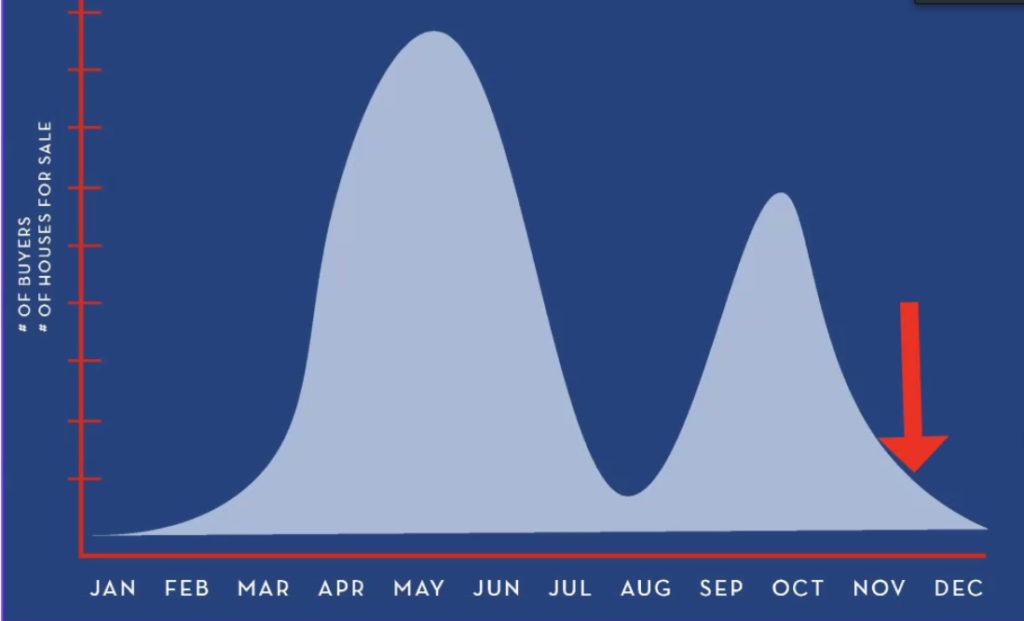

Most years the quantity of listings and buyers bottoms out in December. It’s cold, people are busy with family events, people don’t enjoy moving in the winter…etc. The market looks about like the chart below, where the number of buyers and the number of houses available are closely linked.

The reason the quantity of houses and buyers moves in sync is because sellers (typically) want the highest price when they sell. Listing a home in November or December is likely to result in a lower sale price because fewer people are out shopping, which means sellers are more likely to compromise on price to complete a sale. No one lists at year end unless they need to sell.

What’s more: this year there are even fewer buyers than usual because many were priced-out by higher interest rates or spooked by talk of recession.

Do you follow my drift, fellow thrift seekers?! You have the leverage to get a great deal right now. Many sellers are eager to sell before year end, and your competition is limited. Houses that are not remodeled to current tastes are sitting on the market for months. While the houses that have lingered for a while might not be as remodeled as you would prefer, it also makes them ripe for an offer below asking.

My buyers closed a house recently for nearly 20% below the original asking price. Deals are out there if you’re willing to be creative and aggressive.

Don’t give up on buying a home

If you still want to buy in the near(ish) future, don’t give up. See that chart above? It’s a recipe for finding bargains, but it’s not a recipe for finding the house of your dreams at a bargain price. Dreamboat houses are still selling in days, sometimes above asking. If you have financial flexibility and don’t prize thrift above aesthetics, your dream house is coming…but don’t be discouraged if it’s not available just yet. You will see the pace of listings pick up in the spring market, generally in late February.

What is this mumbo jumbo about jumbo loans?

Disclaimer: I am not a mortgage professional, though I would love to connect you to some I trust. The following is my lay interpretation of jumbo mortgages to help you understand the news this week. It’s broadly accurate, but not precise in details–for that speak to a lender!

You may have seen the news that the limits for conforming loans will go up (a lot!) in 2023.If you’re a first-time buyer, the difference between a conforming loan and a jumbo loan is little more than word salad. Don’t worry, you’re not expected to understand the details yet.

Here’s the thing: when you get a mortgage, someone has advanced a massive wad of dough to you so that you can purchase the house. In exchange you agree to pay back that loan, with interest, over time. That’s simple enough, until you peek behind the curtain…

As you close on your house, the sellers are paid from the loan you secured, and you move in and start paying on your mortgage. Chances are, after a few months, your loan will be sold.

It’s OK, and very common. It’s one of the boring but beautiful things that keeps our economy humming.

The primary purchasers of these loans are companies called Fannie Mae and Freddie Mac. They do additional fancy finance magic with repackaging and reselling, but let’s ignore that for today. (There are exceptions to this. Local banks, like Elevations, keep their loans in house…but about half of all 30-yr conventional, fixed-rate mortgages are re-purchased by Fannie and Freddy so they’re a Very Big Deal.)

Here’s the rub: Fannie and Freddie only have eyes for loans they feel are appropriate in size…loans that “conform” to what they think should be lent. Anything above that amount is called a jumbo loan, and they will not buy it. That means the resale market for jumbo loans is more limited. Less competition in the resale market means that jumbo loans tend to be more expensive for borrowers, and have stricter lending requirements.

When the conforming loan limit increases, fewer borrowers need to secure a jumbo loan. This tends to make it easier and less expensive to secure an affordable mortgage. For example, in Boulder County, the 2023 conforming loan limit will be $856,750 (up from $747,500 in 2021).

I hope this helps you contextualize the news this week! If not, let me connect you to a lending professional I’d trust with my finances. Drop me an email if you’d like an introduction.

Hi, there!

I'm Libby Earthman. I specialize in proactively protecting my clients as they buy and sell homes on Colorado's northern Front Range. I want you to know HOW to make well-reasoned real estate decisions, and I proactively protect your interests during the transaction.

Let's Chat!

Contact

(720) 487-3126

402 Main Street

Longmont, CO 80501

libby@libbyearthman.com